Cross-Border Fintech: Globalization Is Not Dead

Last week, we published a teaser on our Cross-Border Fintech thesis.

That first post laid out the foundational elements of our thesis. In a nutshell, we believe that the global economic order is in flux. Companies will encounter a lot of complexity and friction in their cross-border activities. And that this provides a rich breeding ground for fintech startups.

Over the next few weeks, we will further elucidate our thesis. We will explain in detail the macroeconomic backdrop, the headwinds, the opportunities. We will also highlight the companies already building in this space. Today, we will dive into the macroeconomic backdrop.

A shifting narrative

Public enthusiasm around globalization peaked in the early 2000s. With the Soviet Union gone, Russia and Central and Eastern Europe began opening up to the West. Trade barriers were removed, investment agreements were put in place. China joined the WTO in late 2001, kick-starting its rapid economic opening and growth, which remained at a whopping >40% for a decade thereafter.

The West thrived under this new world order, centred around its own institutions and interests. Companies benefited from access to new consumer markets as well as from an efficient division of labor. Consumer gained from cheaper everyday goods.

However, over time, enthusiasm waned as the downsides of a globalized economy became more visible. Intense competition, the loss of manufacturing capacities, and rising unemployment sparked discontent. Globalization produced losers, who now form an increasingly vocal group of critics. The pendulum has swung to the polar opposite of its early 2000s position. Today, a protectionist rhetoric dominates the public discourse.

Does this shift in narrative have a real effect on the state of the global economy, though? We will explore the data on that in the next section.

The world is (still) becoming more interconnected

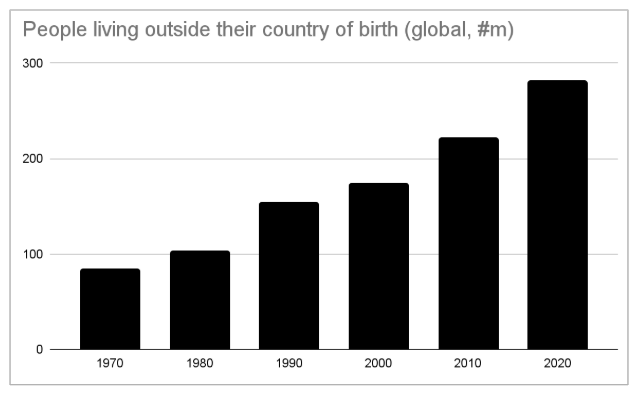

We measure the state of globalization through three proxies: the amount of people, goods, and money crossing borders every year. There are more ways to measure the interconnectedness of the global economy, but we believe these are the key components. Let us look at each of them in more detail.

People: In the 1970s, less than 100 million people were living outside their country of birth. Today, this number is closer to 300 million (World Migration Report). The top three “senders” are India, Mexico, and Russia. The top three “receivers” are the US, Germany, and Saudi-Arabia.

Within the European Union, over 40m citizens currently live abroad; 10 million more than a decade ago. This accounts for pproximately 9% of the total EU population (Eurostat). We believe that future migration will increase as people choose to both relocate and flee poverty, conflict and climate change.

Worth mentioning is also that the Western economies require (a lot of) immigration to balance out their aging population and to keep their economies running at full capacity.

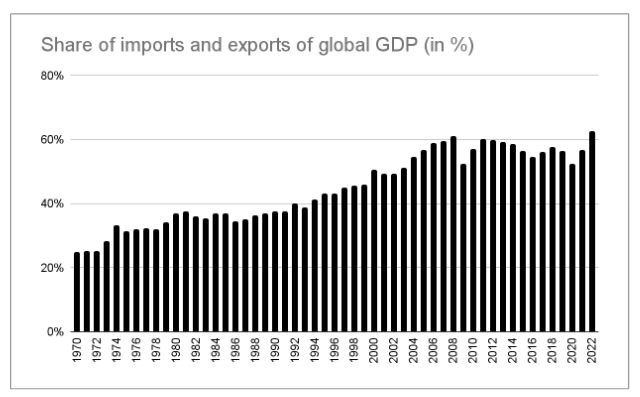

Goods: In the 1970s, imports and exports accounted for around 25% of global GDP. This number has grown to over 60% today (Our World in Data). At the same time, the USD-value of exported goods has tripled over the past 20 years alone (WTO).

While it remains to be seen how future trade wars will affect imports and exports, global supply chains have proven to be remarkably resilient and sticky, even if this involves inventive workarounds (The Economist). The concept of “connector economies”, as exemplified by Vietnam, will become increasingly important, even if they merely mask the fact that globalization remains fully intact.

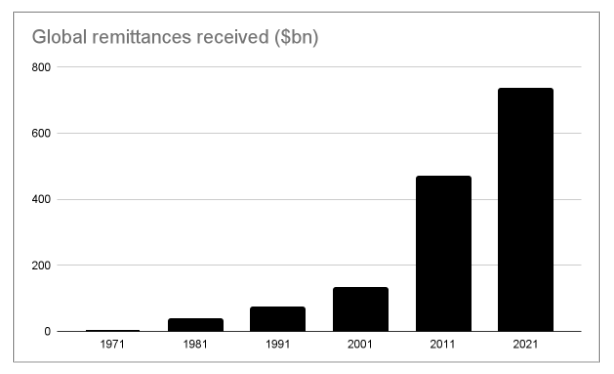

Money: In the 1970s, global remittances were about $2 billion per annum. Today, that figure has soared to over $700 billion (World Bank). This is a great showcase of the interconnectedness of migration, trade and payments.

Global non-wholesale payments (i.e. excluding financial market / securities related transactions) have grown by around 5% annually since 2019 and reached approximately $44 trillion in 2023. Experts forecast that volumes will grow by a 6% CAGR until 2030 (FXCintelligence), driven by the adoption of B2B eCommerce, further globalization of supply chains, and migration.

Friction is an opportunity

It is not just us that see globalization and interconnectedness of our economies at an all time high, despite the massive headwinds. The DHL NYU Stern Global Connectedness Tracker — another proxy for the state of globalization — reached a new record in 2022 and has since remained close to that level.

By all the measures we consider, the global economy is (still) becoming more interconnected. But we believe that sentiment towards globalization will remain negative, meaning that lawmakers will continue to introduce complexity and friction into the system.

This opens up an opportunity for startups to leverage financial technology to reduce the friction companies face in their cross-border operations. It is an existing yet unnamed category that we simply call “Cross-Border Fintech”. It is a category that we believe is becoming increasingly important because there are significant tailwinds to capitalize on.

Over the coming weeks we will continue to delve deeper into the various aspects of our thesis. Join us on this journey to unearth where we see concrete opportunities arise.